What is Difference Between Isolated Margin and Gross Margin on Binance

Margin trading on Binance allows users to amplify their trading positions by borrowing funds. Binance offers two types of margin trading modes: Isolated Margin and Cross Margin.

Understanding the differences between these two options is essential for managing risk effectively and optimizing trading strategies. This guide explains how each margin mode works, their key differences, and when to use them.

Understanding the differences between these two options is essential for managing risk effectively and optimizing trading strategies. This guide explains how each margin mode works, their key differences, and when to use them.

Isolated Margin and Gross Margin on Binance

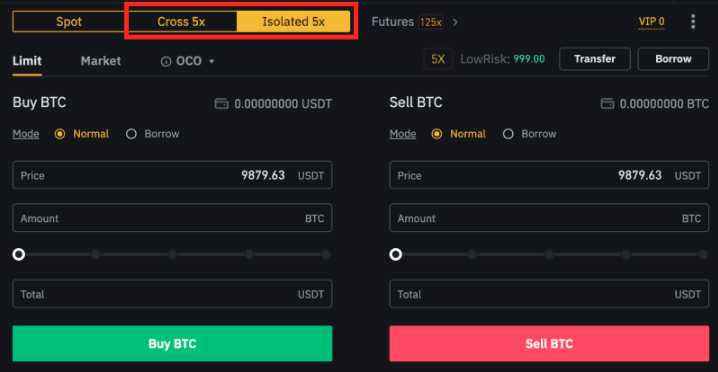

Binance Margin Trading supports cross margin and isolated margin now. You may select cross or isolated in the new trading page, as the following picture:

Margin in isolated margin mode is independent in each trading pair:

- Each trading pair has an independent isolated margin account. Only specific cryptocurrencies can be transferred in, held and borrowed in a specific isolated margin account. For instance, in BTCUSDT isolated margin account, only BTC and USDT are accessible; you may open several isolated margin accounts.

- Position is independent in each trading pair. If adding margin is required, even if you have enough assets in other isolated margin accounts or in the cross margin account, the margin will not be added automatically, and you may have to replenish manually.

- Margin level is calculated solely in each isolated margin account based on the asset and debt in the isolated.

- Risk is isolated in each isolated margin account. Once liquidation happens, it will not affect other isolateds.

For detailed rules about isolated margin trading, you may refer to Isolated Margin Trading Rules.

Margin in cross margin mode is shared among the user margin account:

- Each user can only open one cross margin account, and all trading pairs are available in this account;

- Assets in cross margin account are shared by all positions;

- Margin level is calculated according to total asset value and debt in the cross margin account.

- The system will check the margin level of the cross margin account and then send notification to user about supplying additional margin or closing positions. Once liquidation happens, all positions will be liquidated.

More detailed rules about cross margin trading, you may refer to: Cross Margin Trading Rules

For example:

On Day N, ETH market price is 200USDT and BCH market price is 200USDT. User A and User B transfer 400USDT into margin account respectively as margin balance, and purchase ETH and BCH with 5X leverage in average. Provided User A traded in cross margin account while User B traded in isolated margin accounts (trading fee and interest are not considered in this example).

Day N:

User A trades in cross margin mode:

- Asset: 5 ETH, 5 BCH

- Collateral:400 USDT

- Margin level: (5 ETH*200+5 BCH*200)/1600 = 1.25

- Status: normal

User B:

- ETHUSDT isolated margin account:

- Asset:5 ETH

- Collateral:200 USDT

- Margin level:5 ETH * 200 /800= 1.25

- Status: normal

- BCHUSDT isolated margin account:

- Asset: 5 BCH

- Collateral:200 USDT

- Margin level: 5 BCH * 200 / 800 = 1.25

- Status: normal

Day N+2: Supposing ETHUSDT price rises to 230 while BCHUSDT falls to 170.

User A in cross margin account:

- Asset: 5 ETH, 5 BCH

- Margin level: (5 ETH*230+5 BCH*170)/1600 = 1.25

- Status: normal

User B:

- ETHUSDT isolated margin account:

- Asset:5 ETH

- Margin level:5 ETH * 230 /800= 1.44

- Status: normal with 150USDT profit

- BCHUSDT isolated margin account:

- Asset: 5 BCH

- Margin level: 5 BCH * 170 / 800 = 1.06

- Status: Margin Call triggered, a notification about adding margin will be sent to the user

Day N+5: Should ETHUSDT price downed to 220 and BCHUSDT price dropped to 120, provided that both users choose not to add margins.

User A, cross margin account:

- Asset: 5 ETH, 5 BCH

- Margin level: (5 ETH*220+5 BCH*120)/1600 = 1.06

- Status: Margin Call, a notification about adding margin will be sent to the user

User B:

- ETHUSDT isolated margin account:

- Asset:5 ETH

- Margin level:5 ETH * 220 /800= 1.38

- Status: normal with 100USDT profit

- BCHUSDT isolated margin account:

- Asset: 0

- Margin level: N/a

- Status: margin level is 5 * 120 / 800

Conclusion: Choosing the Right Margin Mode for Your Trading Strategy

Both Isolated Margin and Cross Margin offer unique advantages depending on your trading strategy and risk tolerance. Isolated Margin is ideal for traders who prefer to limit risk to individual positions, while Cross Margin is suitable for those looking to maximize capital efficiency across multiple trades.

Understanding how these margin modes work will help traders make informed decisions and minimize potential losses while leveraging their positions on Binance.

Understanding how these margin modes work will help traders make informed decisions and minimize potential losses while leveraging their positions on Binance.