Who got in Crypto when Bitcoin was $10

We asked crypto influencers, veteran traders, VC fund founders, and more to share their top tips, essential Twitter follows, and the stories behind their best trades ever. In this edition we speak to longtime trader Ray Tong, who is full of practical advice for both new and experienced investors.

Ray Tong stumbled across Bitcoin before most people had even heard of it, while working on a college project in 2011. He got his first bitcoin for when they were just $10, which required a trip to Walgreens to send a Western Union payment to a stranger on the other side of the planet. (Thankfully it’s gotten a lot easier.) When Bitcoin’s price quickly shot up to $30, he was hooked. He got deeper into trading during his post-college years working at Facebook, where he was an active member of a popular internal crypto channel. These days he splits his life between his day job – he’s a product manager at the online fashion site Farfetch, where he builds internal tools that have nothing to do with crypto – and managing his cryptocurrency portfolio. He’s full of practical, everyday advice for both new and experienced traders.

Pro Tips of Manager who now Funds DeFi tech

We asked crypto influencers, veteran traders, and VC fund founders to share their top tips, essential research strategies, and more. In this article, we speak to ParaFi Capital managing partner Ben Forman.

Ben Forman is the managing partner of San Francisco-based ParaFi Capital, a fund that invests in blockchain technology and decentralized finance (or DeFi) markets. He founded ParaFi in 2018 after a decade of working in traditional finance — focusing on private equity and credit markets — at major firms like KKR and TPG. “Outside of Bitcoin as a non-sovereign store of value, DeFi is the main area of the blockchain space that has real product-market fit, real users, and real traction,” he says. “Non-sovereign, uncensorable financial services is where we're focused.”

Moving Averages Explained

Technical analysis (TA) is nothing new in the world of trading and investing. From traditional portfolios to cryptocurrencies like Bitcoin and Ethereum, the use of TA indicators ha...

Market Makers and Market Takers Explained

Markets are made up of makers and takers. The makers create buying or selling orders that arent carried out immediately (e.g., sell BTC when the price hits $15k). This creates liqu...

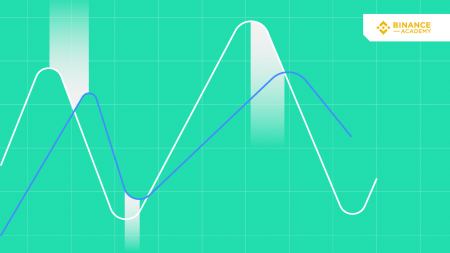

Leading and Lagging Indicators Explained

What are leading and lagging indicators?

Leading and lagging indicators are tools that evaluate the strength or weakness of economies or financial markets. Simply put, leading i...

What Is an OCO Order?

Note: We highly recommend reading our guides on limit and stop-limit orders prior to continuing.

An OCO, or One Cancels the Other order allows you to place two orders at the...

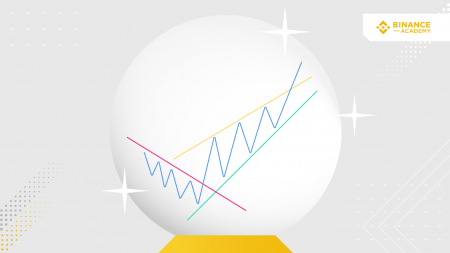

What Is Technical Analysis?

Technical analysis (TA), often referred to as charting, is a type of analysis that aims to predict future market behavior based on previous price action and volume data. The TA app...

What Are Perpetual Futures Contracts?

What is a futures contract?

A futures contract is an agreement to buy or sell a commodity, currency, or another instrument at a predetermined price at a specified time in the fu...

Binance Margin Trading Guide

How to open a Margin Trading account on Binance

After logging in to your Binance account, move your mouse to the top right corner to and hover over your profile icon. This will ...

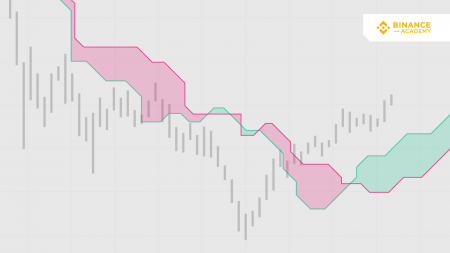

Ichimoku Clouds Explained

The Ichimoku Cloud is a method for technical analysis that combines multiple indicators in a single chart. It is used on candlestick charts as a trading tool that provides insights...

What Are Options Contracts?

An options contract is an agreement that gives a trader the right to buy or sell an asset at a predetermined price, either before or at a certain date. Although it may sound simila...

What Is Margin Trading?

Margin trading is a method of trading assets using funds provided by a third party. When compared to regular trading accounts, margin accounts allow traders to access greater sums ...