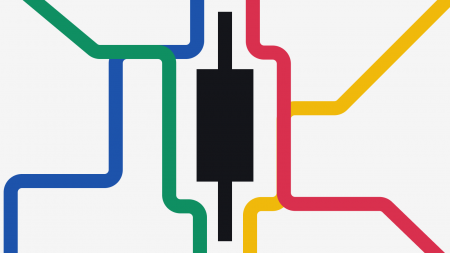

A Beginner's Guide to Candlestick Charts

Introduction

As a newcomer to trading or investing, reading charts can be a daunting task. Some rely on their gut feeling and make their investments based on their intuition. Wh...

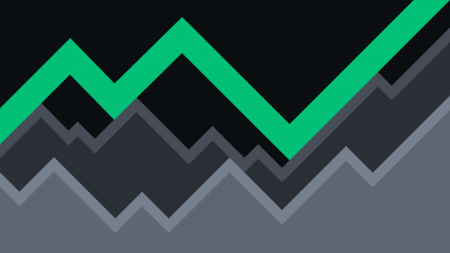

An Introduction to the Elliott Wave Theory

What is Elliott Wave?

The Elliott Wave refers to a theory (or principle) that investors and traders may adopt intechnical analysis. The principle is based on the idea that finan...

Inside the Mind of a Professional Crypto Trader - Nik Patel

Nik Patel, also known as @cointradernik, is a full-time trader, investor, writer, and advisor in the cryptocurrency space. He has been actively involved in the cryptocurrency marke...

Asset Allocation and Diversification Explained

Introduction

When it comes to money, there is always risk. Any investment can incur a loss, while a cash-only position will see value slowly eroded through inflation. While risk...

An Introduction to The Dow Theory

What is the Dow Theory?

Essentially, the Dow Theory is a framework fortechnical analysis, which is based on the writings of Charles Dow concerning market theory. Dow was the fou...

A Simple Introduction to Dark Pools

What is a dark pool?

A dark pool is a private venue facilitating the exchange of financial instruments. It differs from a public exchange in that there is no visible order book,...

What Is a Limit Order?

A limit order is an order that you place on the order book with a specific limit price. The limit price is determined by you. So when you place a limit order, the trade will only b...

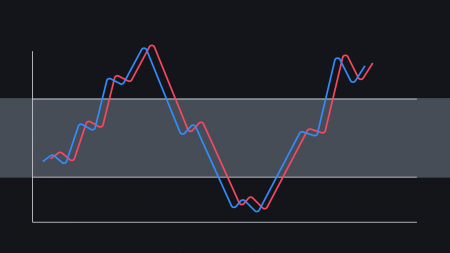

Stochastic RSI Explained

What is Stochastic RSI?

Stochastic RSI, or simply StochRSI, is a technical analysis indicator used to determine whether an asset is overbought or oversold, as well as to identif...

The Ultimate Guide to Trading on Binance Futures

Contents

How to open a Binance Futures account

How to fund your Binance Futures account

Binance Futures interface guide

How to adjust your leverage

What is the differ...

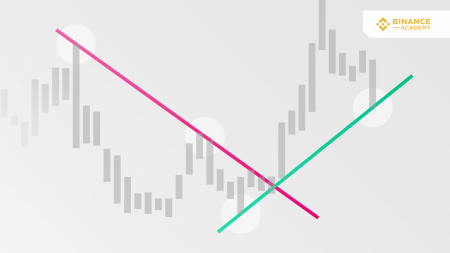

Trend Lines Explained

What are trend lines?

In financial markets, trend lines are diagonal lines drawn on charts. They connect specific data points, making it easier for chartists and traders to visu...

When is the Best Time of Day to Buy Crypto

Cryptocurrencies like Bitcoin can experience daily (or even hourly) price volatility. As with any kind of investment, volatility may cause uncertainty, fear of missing out, or fear of participating at all. When prices are fluctuating, how do you know when to buy?

In an ideal world, it’s simple: buy low, sell high. In reality, this is easier said than done, even for experts. Instead of trying to “time the market,” many investors use a strategy called dollar-cost averaging (or “DCA”) to reduce the impact of market volatility by investing a smaller amount into an asset — like crypto, stocks, or gold — on a regular schedule.

DCA might be the right choice when someone believes their investments will appreciate (or increase in value) in the long term and experience price volatility on the way there.

Crypto Expert Tips of Fund Founder

We asked crypto influencers, veteran traders, VC fund founders, and more to share their top tips, essential Twitter follows, and the stories behind their best trades ever. In this article, we speak to Scalar Capital founder – and former company product manager – Linda Xie.

When you ask crypto experts for a list of the smartest and most clear-eyed people in the space, venture-fund founder Linda Xie is a name that comes up more than just about anyone. Xie (pronounced “shay”) became interested in Bitcoin in college, but it wasn’t until Overstock.com began accepting it as payment in 2014 that she felt optimistic enough about the future of digital money to leave a finance job. She took a role as one of Company’s first thirty employees and eventually rose to become a product manager focused on regulations and compliance. Since 2017, she’s led the crypto investment management firm Scalar Capital, which focuses on cryptoasset startups . “We’re very long-term oriented,” she says. “So we like to get really involved and help out founders and participate in communities.”